when is tax season 2022 canada

But for 2022 this date is a Saturday so were getting a little extension May 2 2022 is our official tax deadline this year. 01 January 2022 First day of new tax year.

1999 Complete Monopoly 2000 Millennium 41295 Etsy Canada In 2022 2000 Completed The Originals

2022 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location.

. The payment deadline is April 30 2022. The snow is starting to melt the birds are beginning to sing and tax season is just around the corner. New Brunswick Minimum Wage History.

For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. If you filed a paper return last tax season in Canada the CRA should automatically mail you the 2021 income tax package by the end of February. Tax filing season officially began on February 21st.

Tax Changes in 2022. The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. If you are looking to file your tax return electronically you must have your personal tax return in by midnight on May 2 2022.

Having the information you need on hand to file your return makes the filing process that much easier. But before you rush. Its that time of year again.

After the time of cheer comes the dreadful tax filing season 2022. The tax deadline in Canada every year is April 30. On April 1 2022 New Brunswicks minimum wage rose to 1275 per hour.

Because April 30 is a Saturday and the CRA isnt that draconian the tax deadline for 2022 is May 2. Many people still think that their returns are due by April 15. This falls on a Saturday so as long as the CRA receives the return on or before May 2 it is considered on time.

Filing deadline for most individuals is April 30 2022. We want to help you get ready so you are in good shape when it. CRAs Dawn Kennedy joins us with tax filing tips.

File your return by the deadline. Posted February 22 2022 1214 pm. Your return can also be postmarked on or before May 2 for it to be considered on time.

Because this date is a Saturday your return will be considered filed on time if the CRA receives it or it is postmarked on or before May 2 2022. April 25 2022 Written by. Federal Tax Rate Brackets in 2022.

You have until June 15 2022 to file your return if you or your spouse or common law-partner are self-employed. Everything You Need to Know About Tax Season 2022 in Canada. Since April 30 2022 falls on a Saturday your income tax and benefit return will be considered filed on time in either of the following situations.

April 28 2022. Since April 30 2022 falls on a Saturday your clients return will be considered filed on time in either of the following situations. For those who are self-employed that deadline is June 15.

Canadians have until May 2 to file their taxes thanks to the traditional deadline of April 30 falling on a Saturday. We know that we have many commercials we share etc with the US so be mindful that many of these commercials state the deadline as. Please be reminded that this is the US tax filing deadline.

Updated February 22 2022 1216 pm. Carbon tax increase of 25 per cent to take effect April 1st Mar 31 2022 The CAI is switching this year to a quarterly distribution however and it wont show up as a. They are looking for answers to their questions trying to find information and wanting to solve any problems they have in doing their taxes.

Mail-in a paper copy. Last-minute tax-filing tips to help you. The Canada Revenue Agency CRA wants to help you and your clients prepare to file their income tax and benefit return this year.

E-file service is closed for maintenance. The minimum wage has increased slightly every April since 2016. It is postmarked on or before May 2 2022.

What you need to know for the 2022 tax-filing season. The last six minimum wage increases are. 02 March 2022 Deadline for contributing to an RRSP for the 2021 tax year.

It can be a bit confusing but in 2022 you should do your taxes for the previous year. Every tax season thousands of people call us each week. Mark your calendar The deadline for most Canadians to file their federal income tax and benefit return for their 2021 taxes is April 30 2022.

Otherwise you can view and download forms from the CRA website starting Jan. This calendar should help familiarize you with Canadas key tax deadlines for 2022. But the tax deadline doesnt fall on April 30 as it normally does.

Let us help you get started. The general tax filing deadline date is April 30th each year but this year the date falls on Saturday so the date is extended up to the next business day. This is the official start of the 2022 tax season and the date that the IRS began accepting and processing returns from tax year 2021.

We receive it on or before May 2 2022. The federal income tax brackets increased in 2022 based on an indexation rate of 24. In Canada tax season runs from January 1st to April 30th.

Last year Canadians filed almost 31 million income tax and benefit returns. Canadian Tax Year - Key Dates 2022. Protect yourself from scams and fraud know what to expect from the CRA.

For the 2022 tax season in Canada the deadline is April 30 2022. The basic personal amount is up to 14398. NETFILE opens on February 21 2022.

Remember that May 2 2022 is actually the tax deadline for last years taxes 2021. 620 Tax Filing Tips. The tax-filing deadline for most individuals is April 30 2022.

This date has been designated Earned Income Tax Credit Awareness Day which the IRSs website says is to raise awareness of valuable tax credits available to many people including the option to use prior. Find the answers you need for the 2022 tax-filing season.

File Your Tax Return Here Irs 13 Oz Banner Non Fabric Etsy Canada In 2022 Vinyl Banners Banner Outdoor Vinyl Banners

Accountant Gift Freak In The Sheets Spreadsheet Mug Funny Etsy Canada In 2022 Mugs Accountant Gifts Lettering Design

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

How To Register And Open A Cra My Account In 2022 Accounting Bookkeeping Business Payroll Accounting

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

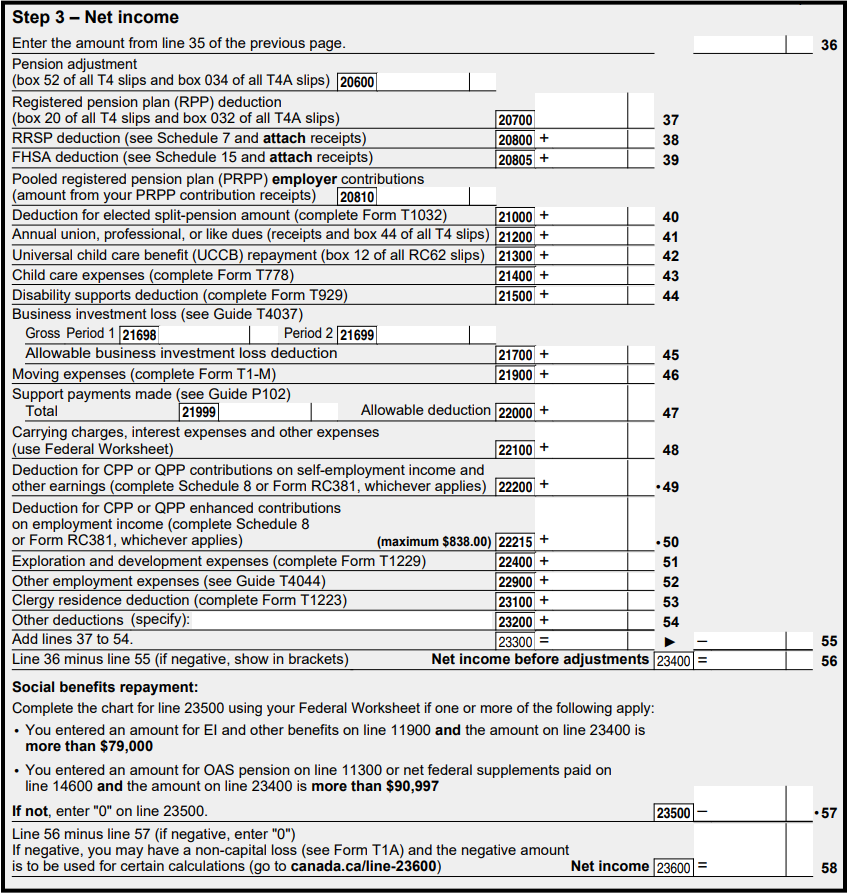

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Income Tax 2020 Changes Every Canadian Needs To Know Income Tax Income Tax Return Tax Return

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Ufile 12 For Tax Year 2021 En 2022 Easy

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Income Tax 2020 Changes Every Canadian Needs To Know Income Tax Income Tax Return Money Mom

Effective Tax Tips To Follow In 2022 Canada 2022 In 2022 Tax Services Tax Preparation Tax

More Tax Refund 9 Ways To Maximize Your Tax Return In Canada How Taxes Work In Canada Youtube In 2022 Tax Refund Tax Return Tax

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Funny Tax Accountant Card Tax Season Card Accounting Card Cpa Etsy Canada In 2022 Funny Greeting Cards Tax Season Friendship Cards

![]()

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Accountant Gift For Tax Season Finance Gifts Audit Gift Sorry Etsy Canada In 2022 Ceramic Christmas Trees Cute Christmas Tree Christmas Mom

Completing A Basic Tax Return Learn About Your Taxes Canada Ca